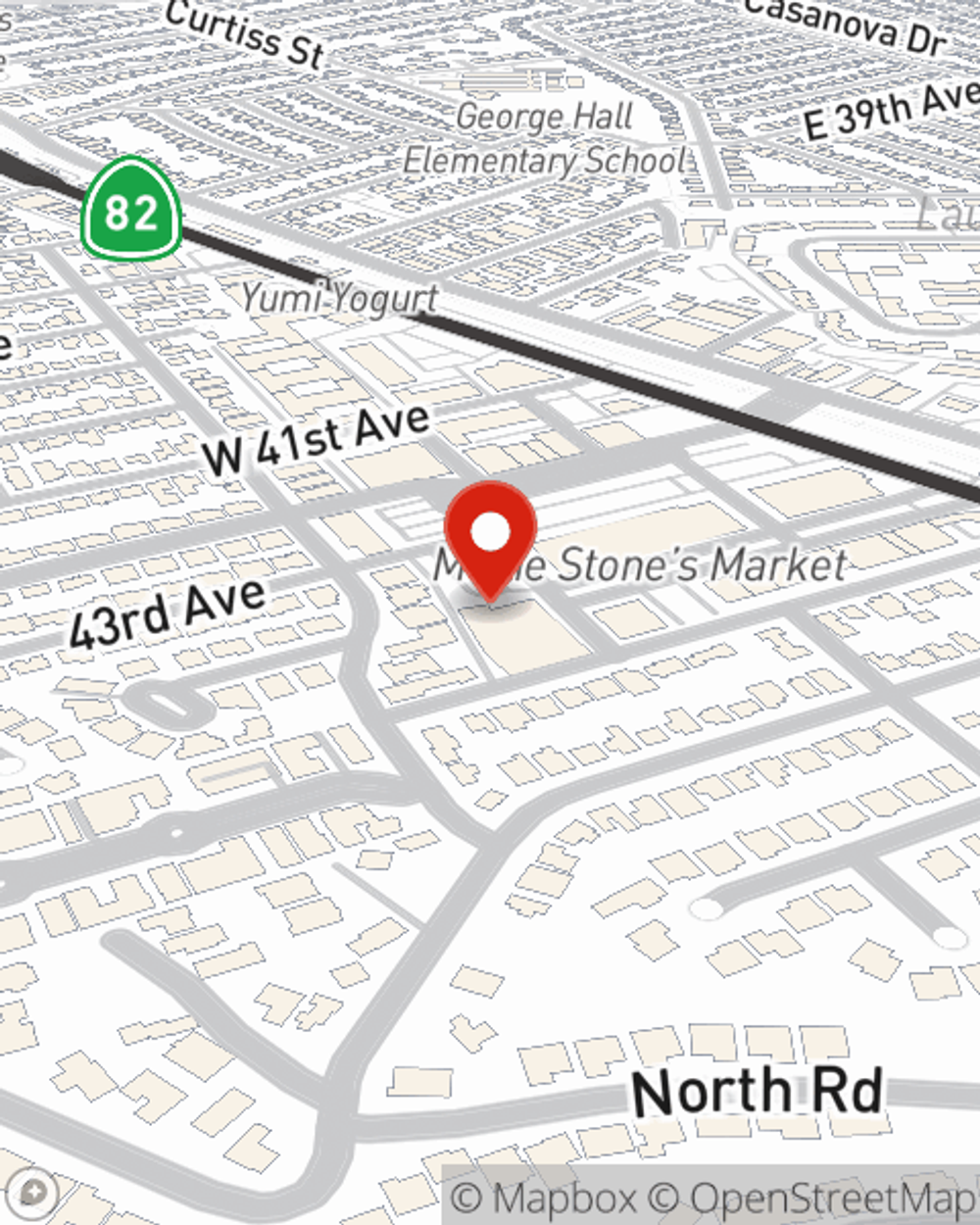

Business Insurance in and around San Mateo

One of the top small business insurance companies in San Mateo, and beyond.

Insure your business, intentionally

- Burlingame

- Belmont

- Palo Alto

- San Carlos

- California/Arizona

- Oregon/Idaho

- Foster City

- the Bay Area

- Menlo Park

- Redwood City

- Emerald Hills

- Hillsborough

Help Prepare Your Business For The Unexpected.

Do you own a pet groomer, a bakery or an art school? You're in the right place! Finding the right protection for you shouldn't be risky business so you can focus on your next steps.

One of the top small business insurance companies in San Mateo, and beyond.

Insure your business, intentionally

Cover Your Business Assets

Your business is unique and faces a wide array of challenges. Whether you are growing a dental lab or a music school, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your space, you may need more than just business property insurance. State Farm Agent Wilson Ku can help with errors and omissions liability as well as mobile property insurance.

The right coverages can help keep your business safe. Consider visiting State Farm agent Wilson Ku's office today to learn about your options and get started!

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Wilson Ku

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.